Will Steel Market stagflation to the top?

Steel prices tended to be stable today, with a few varieties showing mixed ups and downs in different markets, and the average price of a few varieties such as medium plates still moved up slightly, with a range of about 20 yuan. The overall transaction is average, speculative demand has cooled down, and the market has a strong wait-and-see attitude.

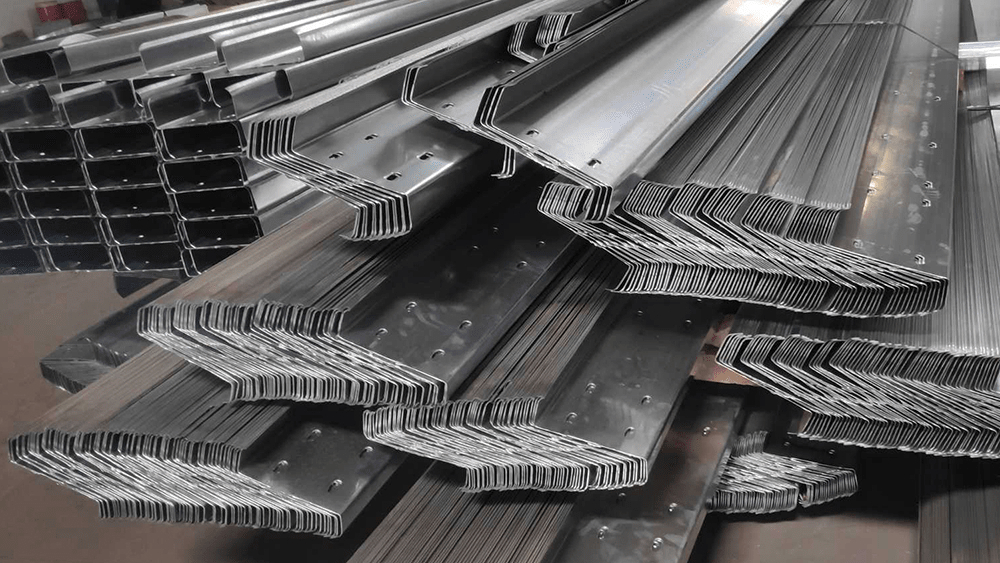

(To learn more about the impact of specific steel products, such as Wholesale Steel Purlin, you can feel free to contact us)

The current steel market is in a state of shock adjustment after the rise. Both the long and the short are restrained, and there is no obvious move to increase the position, but the continued rise does face more pressure, and conditions need to be transformed. In the spot market, there are not many variables in the fundamentals. The fall in demand in winter and the high supply pressure are still the main factors dragging down the spot market. At present, rebar and other varieties in the off-season have accumulated inventory performance. Under the pattern of coke rising for 3 rounds and iron ore prices being high and relatively strong, the center of gravity of steel costs continues to move upwards, and the profit of pig iron is only maintained at about 100 yuan, and the gross profit of finished products remains. at a loss.

(If you want to know more about the industry news on Galvanised Z Purlins, you can contact us at any time)

From the perspective of external conditions, the CPI data released by the United States in the evening and the exchange rate trend after the data are released are also another factor affecting the short-term market. However, as the last interest rate hike by the Federal Reserve this year, there should not be much change in the case of government bond yields and inflationary pressures easing, and the impact on the steel market is generally neutral.

(If you want to get the price of specific steel products, such as Gi Z Purlin, you can contact us for quotation at any time)

From the current point of view, macro expectations have reflected the rise in prices since November. Although technical indicators predict that the economy will face a turnaround next year, there may still be a certain downward adjustment in terms of rhythm, and the range may be around 100 yuan. On the whole, there is a greater probability of a callback.

Post time: Dec-14-2022