Why is it so difficult for steel prices to rebound?

Today’s steel market is generally stable with a decline, and the rebound is weak.

The market turned down again, reflecting that the current deep-rooted contradictions in the market are still difficult to resolve. First, there is still the question of demand. At present, the effective demand is insufficient, and the pressure is transmitted to the upstream. It has reached the stage of accelerating the profit from the upstream, or forcing the upstream to shrink the supply. Overseas demand has not improved significantly, export pressure has not diminished, domestic demand has been weak, and imports have also remained low.

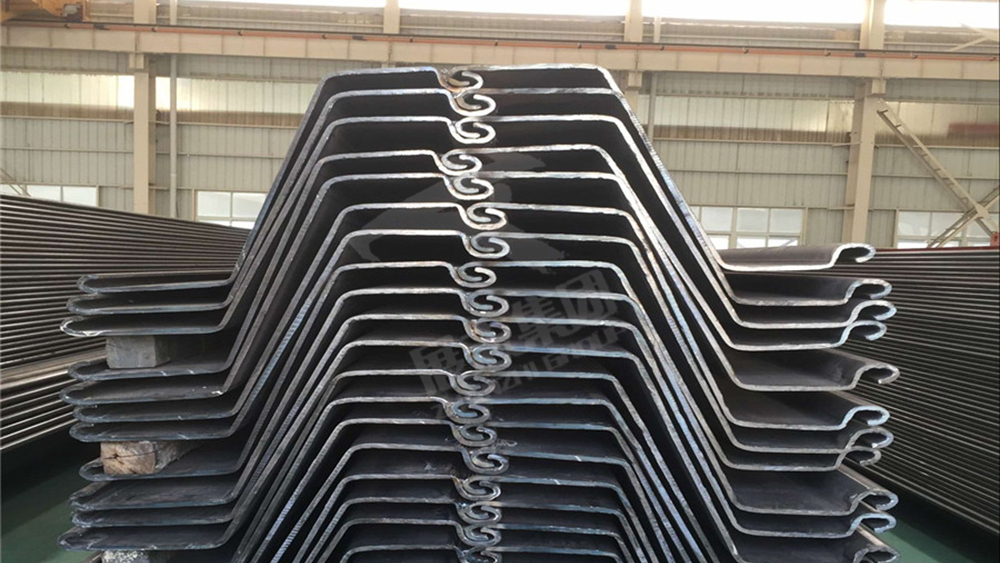

(To learn more about the impact of specific steel products, such as Z Type Steel Sheet Pile, you can feel free to contact us)

Looking at the world, the level of inflation has not fallen as fast as expected and energy prices, showing repeated and tenacious characteristics. This makes the monetary policies of various countries difficult to work, the economy is “stagflation” and geopolitical risks are heating up. In addition, the Fed’s policy interest rate remains high, and financial vulnerability may spread from asset discounts caused by high interest rates to credit risks. These are risks. The decline in steel prices is no longer a simple issue of steel supply and demand, but a complex domestic and foreign economic environment.

(If you want to know more about the industry news on Steel Sheet Pile Manufacturers, you can contact us at any time)

From the current point of view, the fundamentals of this week have not changed much, and more impacts still come from raw materials and domestic and foreign macro disturbances, especially the constant rumors of domestic stimulus policies, as well as foreign U.S. debt and the Fed’s interest rate hikes. The dust has not settled, and there is something to look forward to. This makes the market since this week reflect the divergence between long and short, and it is also mixed with the dilemma that the risks have not been fully released, and the problems and contradictions are still obvious.

(If you want to get the price of specific steel products, such as z shape sheet pile, you can contact us for quotation at any time)

However, coking coal and coke continue to hit new lows, and the futures and currents are weak, not switching rhythms. This will still have a dragging effect on steel products, and steel prices will continue to be weak.

Post time: May-31-2023