Why do limited production “small compositions” continue? Real estate and then thunder caused steel prices to fall?

Today, the steel market as a whole fell slightly. Although a part of the market is still operating stably, the market feedback is poor, the sentiment is bad, and the overall market shipments are poor. This kind of shipments has declined significantly since August.

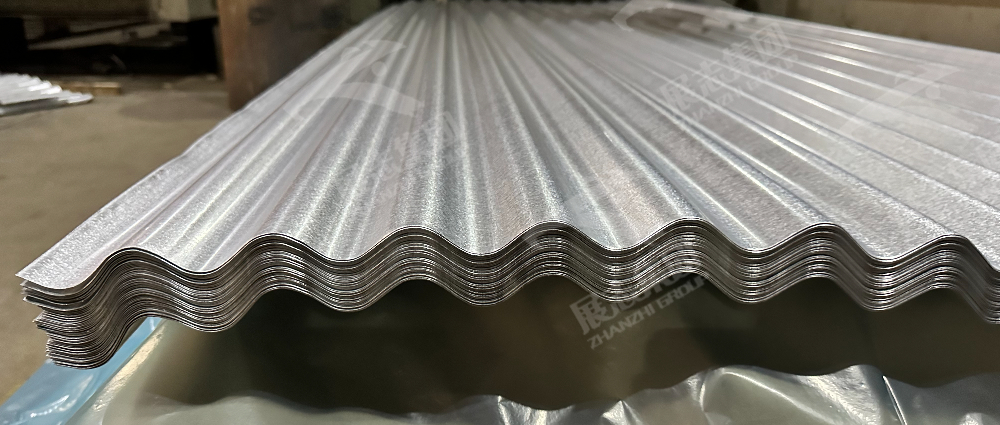

(To learn more about the impact of specific steel products, such as Galvalume Roofing Sheet Manufacturers, you can feel free to contact us)

On the other hand, the July import and export data came out. In fact, the export value in July fell by 14.5% year-on-year, which was further expanded from the -12.4% decline in June, reflecting that the pressure on exports was still relatively high. Although steel exports have maintained a good growth trend, the overall foreign trade environment, especially the PMI new export order index has shrunk to a low level for four consecutive months, indicating that the recent domestic economic growth depends on exports to boost the effect is limited.

(If you want to know more about the industry news on Galvalume Roofing Sheet, you can contact us at any time)

Since the beginning of this year, the situation in the steel market has fallen short of expectations. The apparent consumption of steel has not improved substantially. The upstream and downstream mismatches in the supply chain of the industrial chain are serious. The price of raw materials and fuels is relatively high. The overall situation is more severe than last year, and the industry’s losses have increased sharply. The crisis of enterprise survival is fully manifested.

(If you want to get the price of specific steel products, such as Galvalume Roofing Sheets Price, you can contact us for quotation at any time)

From the current point of view, the market decline has not yet come to an end. The reason why there are various versions of “small essays” on production reduction is that the specific information of the production reduction document has not been made public for a long time, which makes the market speculate endlessly, which also reflects the difficulty of promulgating the production reduction policy. The market is easy to understand. The current unfavorable factors are mainly the continuous decline in transactions (shipments), the increased impact of extreme weather such as heavy rains, and the fear of thunderstorms in real estate again. Looking back, the debt crisis of real estate companies is due to factors such as favorable timing and geographical location, as well as deep-seated operating problems. In the case of rapid expansion and high profits in the first 20 years, it is now entering a deep adjustment cycle, and it is normal for major integration to occur. But it will not shake the original intention of the policy of letting real estate drag the economy down, and there will be policies. In the short term, steel prices are under pressure, but the space is limited.

Post time: Aug-09-2023