Uninterested in fighting before the festival, steel enters the concussion situation

Yesterday, the spot spot in the steel market was mainly stable, while the steel futures fluctuated and weakened. Affected by futures shocks and declines, individual spot prices were adjusted down, while the mainstream remained stable. Judging from the overall market feedback, terminals are only purchased on demand, and some of them have already started holidays. The off-season effect of the market is obvious. Most traders have no intention of selling this week, and most traders will start holidays next week.

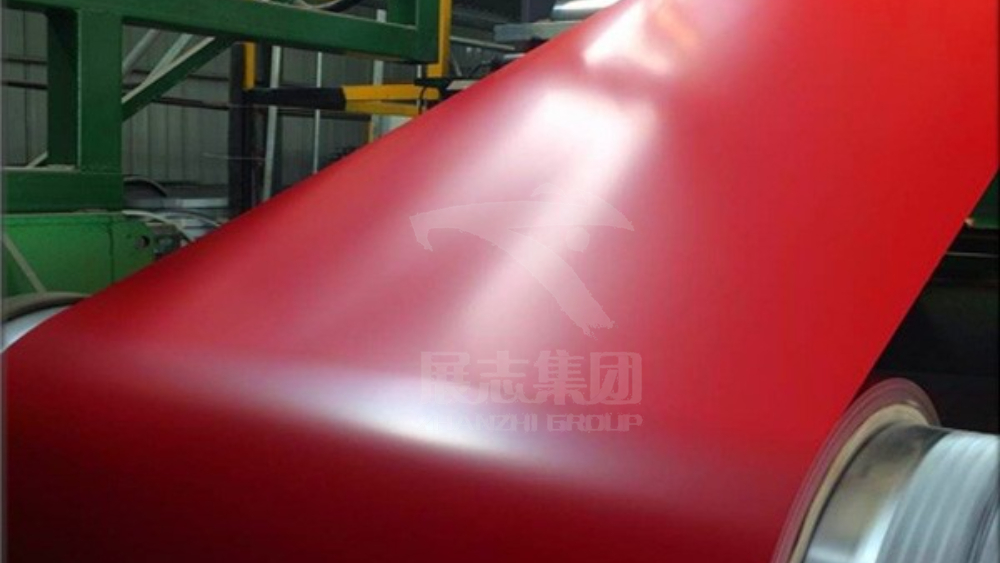

(To learn more about the impact of specific steel products, such as Wholesale Ppgl Coil, you can feel free to contact us)

From the perspective of external news, market transactions have returned to the theme of economic recession. Crude oil has been under pressure recently, but there is still some support for the low level. At present, the trend of the energy and chemical sector is slightly divergent. The minutes of the Federal Reserve’s December interest rate meeting released important information again. The pace of interest rate hikes will slow down, and the interest rate level will also be higher.

(If you want to know more about the industry news on Ppgl Steel Coil Factory, you can contact us at any time)

At present, the main trading logic of the market is still the anticipation of demand recovery in the post-epidemic period, as well as the hedging of the current status quo that demand continues to weaken under the influence of the off-season effect of the market. It is expected that there will be no major changes before the holiday. The market is mainly closed, and it is difficult to see obvious changes on the demand side. At the end of the year, traders will mainly pay more.

(If you want to get the price of specific steel products, such as Ppgl Steel Coil, you can contact us for quotation at any time)

From the perspective of raw materials, although the amount of iron ore arriving at the port has increased recently, steel mills have kept the pace of replenishment unchanged, which has relieved some of the pressure on arriving at the port to a certain extent. Coking coal and coke have not improved significantly in the near future. From the perspective of production, high costs still restrict the profit margins of steel mills.

On the whole, the pre-holiday market will remain volatile, and the possibility of large price fluctuations is unlikely. The spot market is often closed, and accounts are mainly required, and the price fluctuation space refers to 10-30 yuan/ton.

Post time: Jan-06-2023