Steel prices plunged, why did the steel market turn around overnight?

Affected by the small non-agricultural data in the United States that exceeded expectations last night, high inflation continued, the probability of further interest rate hikes increased, and overseas risks intensified, which was negative for commodities. Non-ferrous metals, chemicals, and agricultural products all fell sharply. Steel futures fell sharply, and the sentiment in the spot market was sluggish.

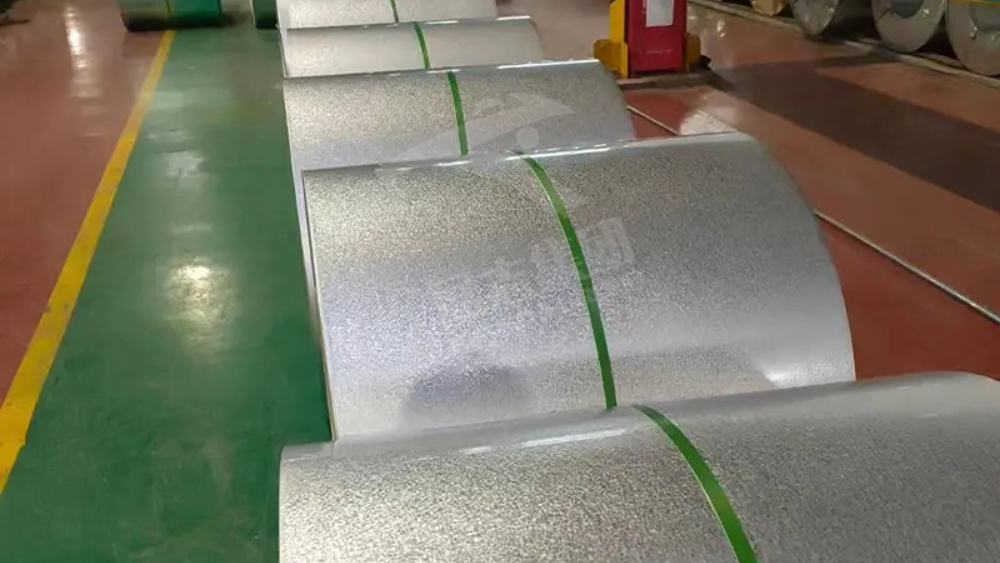

(To learn more about the impact of specific steel products, such as Supplier Coil Galvalume, you can feel free to contact us)

As the number of small non-agricultural employment in the United States increased sharply in July last night, far exceeding expectations, the data reflected that the inflation of the U.S. economy continued, and the U.S. credit rating was downgraded from the highest level of “AAA” to “AA+”. The fiscal situation will continue to deteriorate in the next three years, and the government’s debt burden remains high and continues to increase. The increase in the probability of the Federal Reserve raising interest rates has led to a drop in commodity prices and a general decline in the futures market, which affects the operating sentiment of the domestic steel market and is negative for steel prices.

(If you want to know more about the industry news on Galvalume Coil Price, you can contact us at any time)

In the case of slow recovery of the overall economy, the enthusiasm for automobile consumption needs to be further stimulated, the manufacturing data is still below expectations, and the consumption of steel products has declined, which is negative for the price trend of steel products.

(If you want to get the price of specific steel products, such as Coil Galvalume, you can contact us for quotation at any time)

Affected by manufacturing data that fell short of expectations, the comprehensive output index declined. In addition, after the Politburo meeting, various policies were gradually implemented, but the impact was limited. The arrival of typhoons and heavy rains has exacerbated the sluggish demand, especially the favorable policies for manufacturing. The industry is limited, dragging down the economic recovery, and the demand for steel is declining, which is negative for the price trend of steel products.

At present, affected by the international and domestic macro-environment, the futures and stock markets have weakened in an all-round way, and the spot market operation sentiment is sluggish. The price may run steadily, with a range of 10-20 yuan/ton.

Post time: Aug-04-2023