Steel prices fell below the lowest point of the year, and the downward trend has not changed

In October, steel prices continued to fall, and the decline at the end of the month continued to accelerate. In the last two trading days, the price of rebar futures plunged sharply, and the spot price of futures both fell below the lowest point of the year.

The disk rebounded on November 1st, but this does not mean that the market is about to usher in a reversal. From the current point of view, the downward trend of steel prices has not changed under the influence of the Fed’s interest rate hike, the epidemic situation and raw material concessions.

1. Raw material profits are high, and there is still room for downside

Recently, the continuous decline of steel prices has led to a sharp reduction in the profits of steel mills, and some varieties have suffered significant losses.

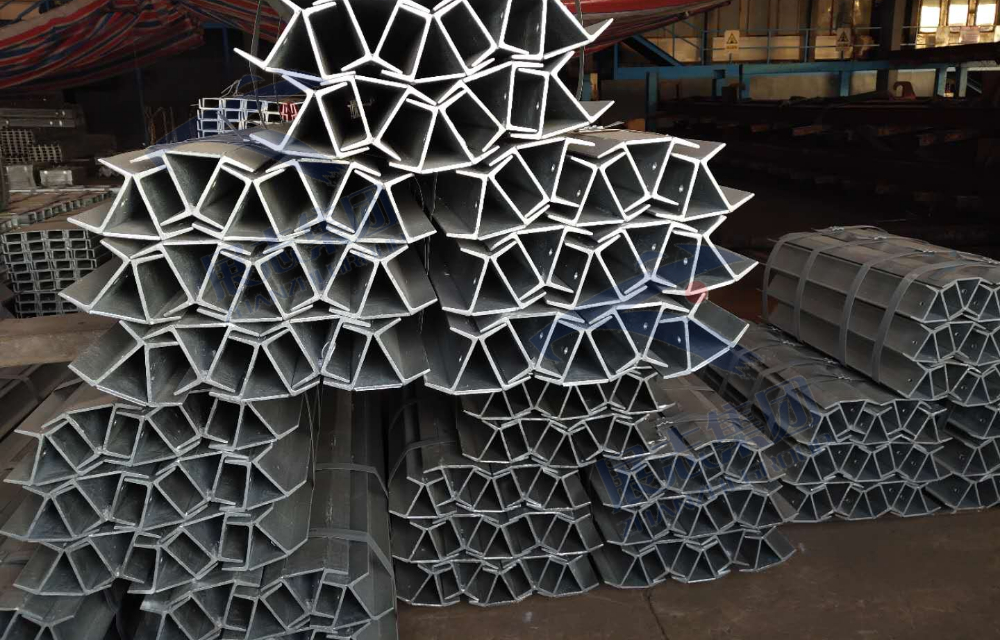

(To learn more about the impact of specific steel products, such as 45 Degree Retaining Wall Post, you can feel free to contact us)

The contraction of steel mill profits, in addition to the decline in steel prices, is not unrelated to the high raw material prices. Since the beginning of this year, the international bulk commodity market has fluctuated greatly, and the prices of major steel-making raw materials such as coking coal, coke, iron ore, and scrap steel have risen rapidly, resulting in a substantial increase in the cost of steel production. The purchase cost of imported iron ore, although down year-on-year, is still higher than the same period in 2019 and 2020.

With the sharp decline in profits and even losses of steel mills, this will form a negative feedback on the prices of raw materials such as coking coal and iron ore with higher profits; and the current domestic iron ore price is higher than the international price, so the iron ore price in the later stage will be negative. , coking coal and other raw fuel prices have room for further decline. The decline in raw fuel prices will also weaken the support for steel prices.

(If you want to know more about the industry news on Galvanised Steel Retaining Wall Posts, you can contact us at any time)

2. Fed rate hike is imminent, market confidence is low

This Thursday, the Federal Reserve will usher in the sixth interest rate hike, and the market expects a high probability of raising interest rates by 75 basis points, and there may be a larger interest rate hike during the year. The sharp increase in interest rates by the Federal Reserve will have a negative impact on commodity prices, exchange rates, the stock market and even real estate, which will lead to low market confidence and increase the downward pressure on the disk.

(If you want to get the price of specific steel products, such as Gal Retaining Wall Posts, you can contact us for quotation at any time)

At present, the disk has fallen to a new low in 2 years, and the market confidence is poor. There are short funds to profit and liquidate positions, resulting in an upward lightening of positions. In the later stage, it is still not ruled out that capital may continue to kill according to conditions. But on the other hand, the market will never drop to the bottom in 2015.

Post time: Nov-02-2022