Rate cut! Control costs! Policies are issued frequently, and the steel market may fluctuate or intensify

Today’s steel market is dominated by overall rises. Prices of cold-rolled, medium plates and profiles, and some pipes also rose to a certain extent, but the range was relatively small.

Why did the market trend change overnight?

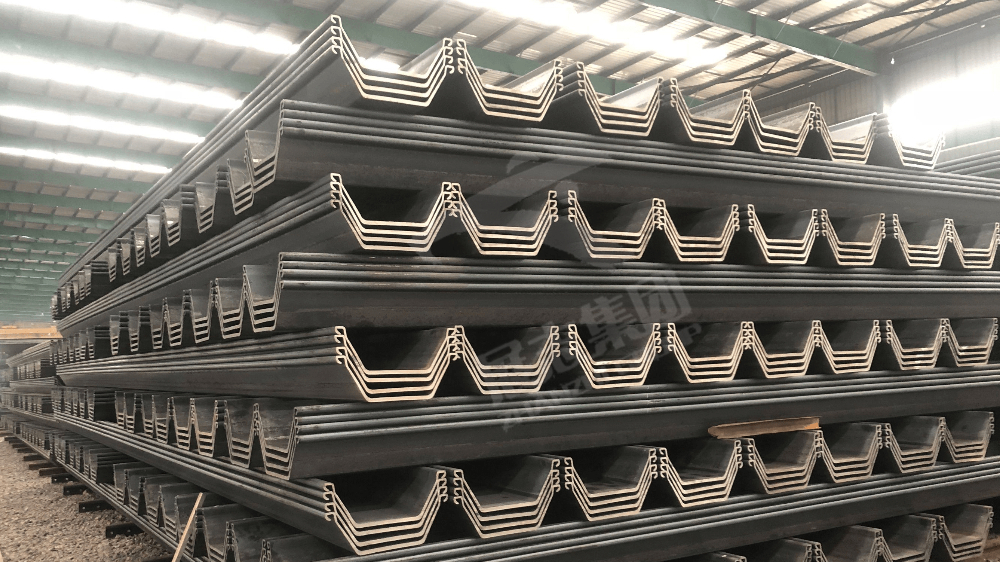

(To learn more about the impact of specific steel products, such as Steel Sheet Pile, you can feel free to contact us)

From the rapid rise in late trading last night to today’s futures and spot stocks continue to rebound, it shows that the market is still playing a positive role. There are two main aspects to this:

On the one hand, it is the stimulus and guidance of interest rate cuts.

On the other hand, there are rumors in the market that the output control policy requires Hebei Province to reduce output by 13 million tons as per last year. At present, there is still no definite news to confirm the feasibility of the policy implementation, but the market is hyping the news as a favorable condition.

(If you want to know more about the industry news on Steel Sheet Pile Types, you can contact us at any time)

Judging from the current market operating conditions, steel prices are stimulated by favorable policy expectations, long-term funds and sentiment are warming up, and a large amount of funds have entered rebar, pushing up the disk market and driving spot prices to follow up. It should be noted that the current market rebound has little to do with fundamentals. At the same time, the financial data is mixed, and the news of interest rate cuts is more important in hedging social finance and even the macro data in May.

(If you want to get the price of specific steel products, such as Steel Sheet Pile Type 3 you can contact us for quotation at any time)

If the interest rate is lowered in the next step, it is possible to hedge against the Fed’s interest rate hike, but the market is already trading this benefit, and even if it comes out later, the impact will be relatively limited. In the short term, we will focus on the impact of today’s new notice from the National Development and Reform Commission, and the market will fluctuate and may repeat. A small rise is pleasant, but a big rise can hurt.

Post time: Jun-14-2023