It’s confirmed, this week’s steel prices go like this!

Consistent with the previous forecast, on August 27th, the steel price in the spot market was stable and slightly lowered. Steel prices fluctuated upwards last week. The recent property market bailout policy is still being explored. The start of the project may be accelerated due to the “big inspection”, but it still takes time to verify whether the demand is expected to be fulfilled. It is expected that the steel price this week may first Weak after strong adjustment.

1. The inventory of the five major varieties continued to decline this week

This week, the total inventory of steel in sample warehouses in 35 major markets across the country was 11.4433 million tons, a decrease of 330,500 tons or 2.81% from last week. This week, social inventories have fallen for the tenth consecutive week, but the decline has narrowed month-on-month. The main reason is that steel mills in some areas have resumed production and supply has increased month-on-month, but terminal demand has not increased significantly, which has a negative impact on the rebound in steel prices.

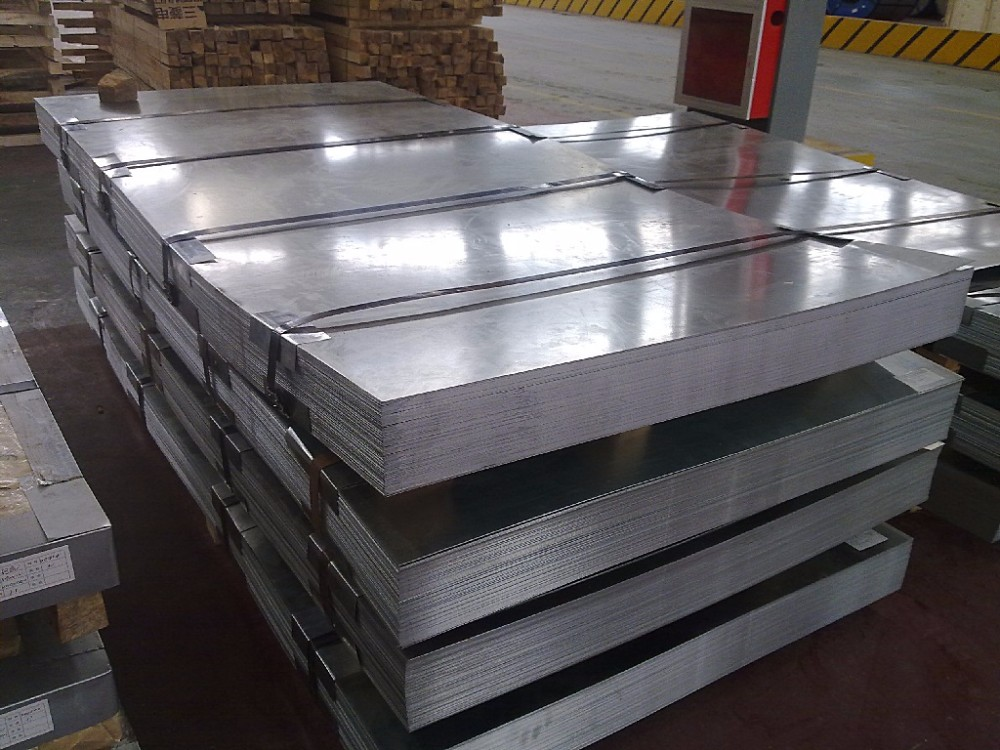

(To learn more about the impact of specific steel products, such as 14 gauge galvanized steel sheet, you can feel free to contact us)

2. From January to July, the profit of the national steel industry fell by 80.8% year-on-year

From January to July, the profits of the steel industry decreased year-on-year, especially after the sharp decline in steel prices in the second quarter, the losses of steel enterprises led to production reductions, which in turn eased the contradiction between supply and demand, and steel prices rebounded slightly. With the recent resumption of blast furnace production and the increase in supply, steel prices may face the risk of falling in the case of insufficient demand follow-up.

(If you want to know more about the industry news on astm a526 galvanized steel sheet, you can contact us at any time)

3. The blast furnace resumes production in September

If the blast furnace continues to resume production in September, the supply of steel will continue to increase. On the market in September, the performance of terminal demand will be greatly tested. If as the weather turns cooler, the off-season market ends and demand gradually improves, then both supply and demand will increase, which is expected to drive steel prices to rise moderately. However, if demand expectations fail, steel prices will face greater downward pressure.

(If you want to get the price of specific steel products, such as galvanized sheet metal for sale, you can contact us for quotation at any time)

Driven by the positive macro, steel prices fluctuated upwards this week. In terms of supply and demand, blast furnaces have gradually resumed production, and production has continued to increase. However, due to the reduction in production in the early stage, the inventory has been at a historically low level, and the supply pressure is not large. In terms of demand, there are signs of recovery in terminal demand, but market merchants are not confident enough. Overall, demand still weak.

Constrained by the cost, the current steel enterprises are generally in the general resumption of production, and the weak supply and demand pattern may continue. The recent property market bailout policy is still being explored, and the start of the project may be accelerated due to the “big inspection”, but it still takes time to verify whether the demand is expected to be fulfilled. On the whole, it is expected that the steel price may weaken first and then strengthen next week. , shock adjustment.

Post time: Aug-29-2022