Futures metal fluctuates widely! Will it Rise or fall after the shock?

Today’s market is still in a weak callback, and steel futures and spot prices have declined to varying degrees. In terms of varieties, the market for building materials and plates has seen a slight drop of 10-30 yuan, and some building materials and steel mills have lowered their ex-factory prices by 20-50 yuan, putting pressure on prices. The other species although the decline is not obvious.

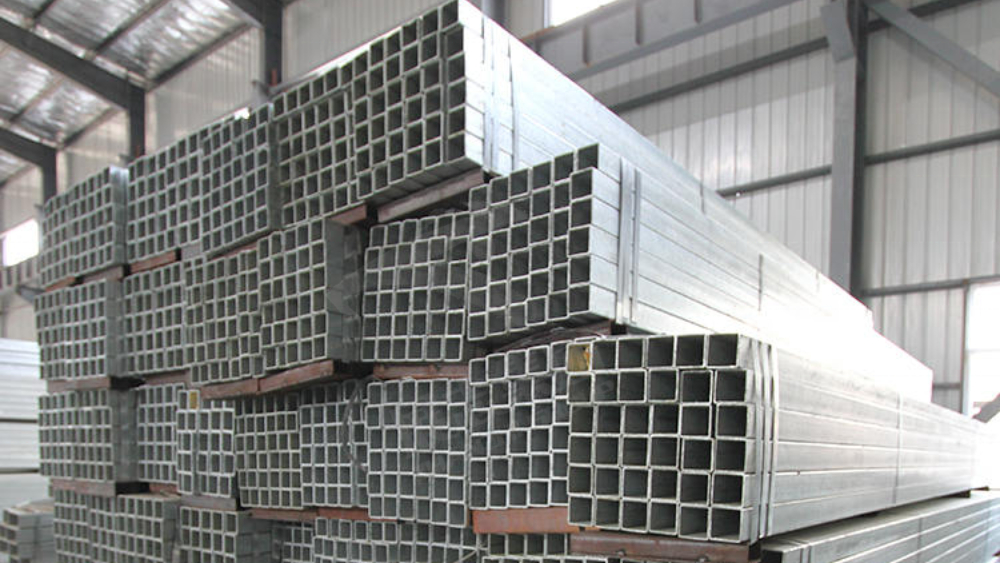

(To learn more about the impact of specific steel products, such as Galvanized Hollow Section, you can feel free to contact us)

From the current point of view, although the favorable policies have not been exhausted, the market is still following expectations, and the positive expectations have been traded in advance, but policies such as interest rate cuts have not been able to resist the weakening rhythm of the market.

(If you want to know more about the industry news on Gi Pipe Square, you can contact us at any time)

From the perspective of the external environment, the global economy is hot and cold, Germany and the euro zone are in technical recession, and the RBA still wants to raise interest rates. The decline in energy prices such as crude oil and overall inflation, coupled with issues such as employment and trade disputes, has a long way to go for recovery. China is still facing two-way pressure from external demand and domestic demand. In terms of boosting domestic demand, it is necessary to continue to observe real estate trends after the relaxation of real estate policies and the pace of recovery of enterprises in the industrial sector.

From the current point of view, as the Dragon Boat Festival approaches, the market has not yet seen pre-holiday stocking behavior, which is consistent with the performance before the 5.1 holiday.

(If you want to get the price of specific steel products, such as Gi Pipe Price you can contact us for quotation at any time)

Currently in the policy window period as a whole, which is also the traditional off-season, the market still needs to be boosted by expectations, and the role of strong expectations is still there. This is not only reflected in the expectations for policies, but also in the expectation that the recovery in the second half of the year will be better than that in the first half. Therefore, the short-term market decline will not be smooth. In addition, the rise in the price of coke at the raw material end will also have some support for steel prices. But from the perspective of rhythm, on the one hand, the risk of futures rising and falling is released, and the spot is also cashing out at high levels after the rebound of steel futures, increasing the frequency of disk shocks. Therefore, from the point of view of the spot market, part of the spot market may still fall, but due to the expectation that it is still there, the adjustment in a short period of time is not large.

Post time: Jun-21-2023