After the crash, can steel futures hold the 4000 mark?

Last Friday night, the decline accelerated. On Sunday, spot traders in many places sold at low prices. The decline continued at the opening on Monday, and quickly fell below the 4,000 mark, basically meeting the expectations on Friday. Judging from the current feedback from the disk, most of the shorts have left the market with profits, so the late trading was able to close slightly, but the overall risk has not been out of the zone. And with the price falling ahead of schedule, the overall center of gravity will be lower than expected again.

Today’s futures made up for the sharp decline, driving the spot price lower. In the afternoon, the futures tried to warm up, and the spot price rebounded from the ultra-low price.

Judging from the trend of Friday night trading, concerns about economic weakness still continued, plus the previous short-term orders continued to be held, and the disk did not give opportunities, resulting in the lack of willingness for shorts to leave the market. However, the continuous fluctuations on the disk and the re-emergence of the domestic epidemic have triggered the disk’s worries about the recovery of the demand side and the worries about the economic pressure, which in turn prompted the shorts to complete profits.

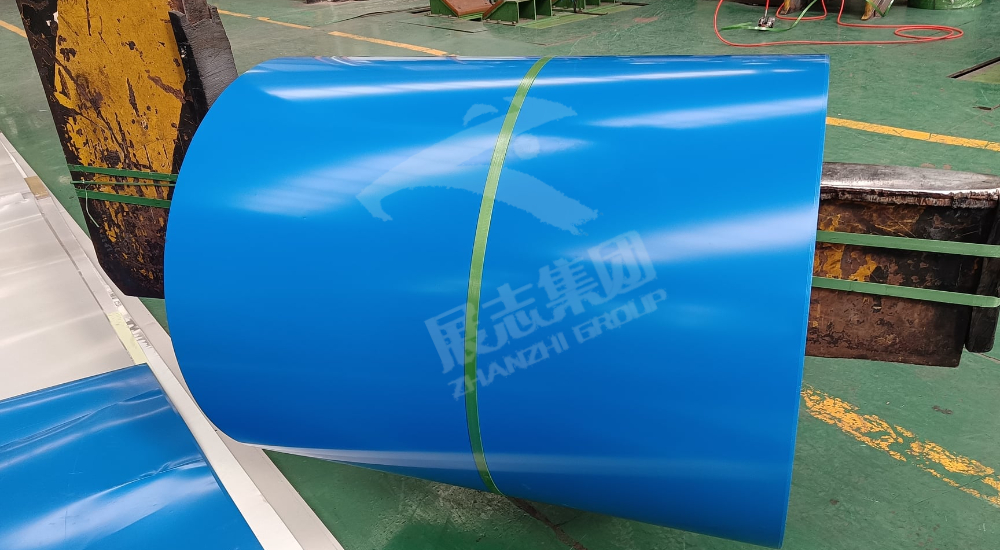

(To learn more about the impact of specific steel products, such as Pre Painted Steel Coil Suppliers, you can feel free to contact us)

Various data came out last week, and the less-than-expected reduction in production by steel mills was also one of the reasons for the price drop this time. Although the active maintenance area of steel mills has expanded recently, the scope of active production reduction is limited, and the cost support still exists. To a certain extent, the reduction in production was less than expected. For the market, it is nothing more than a transmission of bearish factors.

(If you want to know more about the industry news on Prepainted Galvalume Steel, you can contact us at any time)

Coupled with the re-emergence of the epidemic in East China, investors have great doubts about the demand-side recovery under the influence of the epidemic. It is generally believed that under the influence of the epidemic, demand will continue to weaken rather than strengthen under the stimulus.

(If you want to get the price of specific steel products, such as Coil Ppgl, you can contact us for quotation at any time)

At present, the sentiment is still pessimistic, especially the worries caused by the global economic recession continue to exist, superimposed on the repeated epidemic situation in East China, and the trend of technical decline, which is the trigger for this round of price decline. After the periodical oversold, the market is also expected to rebound. We will pay attention to whether the disk will continue to grind to the bottom on Tuesday. If the data on Wednesday is relatively neutral, it will promote a new round of small rebound in the disk. However, from the current point of view of contradictions, even if the staged bottom grinding is completed within a week, the rebound space is relatively limited.

Post time: Jul-11-2022